Home prices remain near all-time highs, largely due to the continuing low inventory levels. This is in spite of the average 30-year mortgage rate hitting a 23-year high in October at 7.79%.

Higher mortgage rates tend to drive market slowdowns. As an example, from when the Fed began raising rates at the beginning of 2022, the median monthly cost of a home rose 76% higher.

So the question is, why have home prices not adjusted down even though the cost of financing has greatly increased the monthly cost to purchase a home?

One factor is homeowners considering selling their home require prices to stay at current levels, or else they are not likely to sell. 75% of homeowners have mortgage rates under 3.875%, which keeps sellers reluctant to give up their current low mortgage rate. If home prices adjust down, there may be even fewer sellers placing their homes on the market. A lower selling price means less down payment for their replacement home at the same time they are doubling their mortgage interest rate.

Although people move for many reasons, only a very few sell because of financial trouble. Less than 1% of homes are in foreclosure. And most potential sellers require enough profit to offset the higher mortgage rate for their new home, or they will delay their move. A recent survey reported 45% of homeowners would like to move, so it will be interesting to see when this pent-up demand breaks free and increases home inventory. More homes for sale translates into softer prices.

The same holds true for new construction. It also requires profit, or it simply isn’t built. Materials, labor, and financing costs are much higher for homebuilders today. And when a house costs more to build, the price must increase as well. If builders cannot make an acceptable profit, then they simply build less homes, which maintains the “demand exceeding supply” market.

Inflation hasn’t helped homebuyers either. People tend to feel less wealthy than they did three years ago. In just the three years from November 2020 to November 2023, the dollar lost about 15% of its buying power. This is the same amount the dollar lost over the preceding 10 years (November 2010 to November 2020). Even though inflation appears to be easing, this just means prices are not rising as fast as last year. It doesn’t mean goods and services are more affordable. Salaries will need to rise faster to improve buying power.

High mortgage rates may soften some, but not significantly. Inflation is still about twice as high as the Fed wants. So far, most of the economic slowing the Fed intended by raising rates seems to be mostly affecting the housing market. The number of homes sold dropped another 15.4% year over year, and homes for sale is averaging about 50% of standard inventory levels over the past 35 years.

We included data for the U.S. and additional local data for Southern California below.

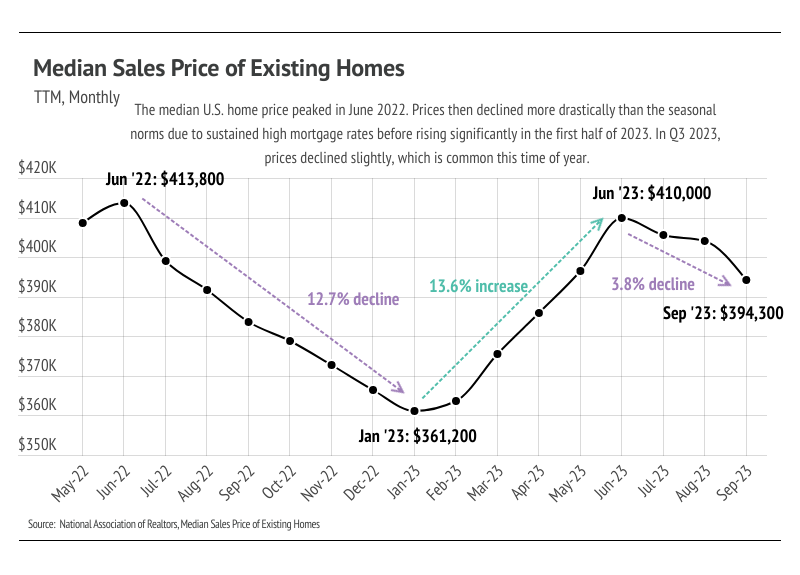

National Data

Cypress, California Real Estate

- Median home prices are expected to remain fairly stable through December.

- Active listings declined slightly from September to October, continuing the 14-month downward trend. Year over year, inventory is down 26%, highlighting one of the challenges of buying a home even though mortgage rates are above 7%.

- Months of Supply Inventory declined in October as sales increased and inventory declined, indicating a still favorable sellers’ market. It’s typical for home prices to adjust down 5% in November and December when fewer buyers are in the market. But very low supply still has demand exceeding availability for desirable homes.

Prices remain near record highs

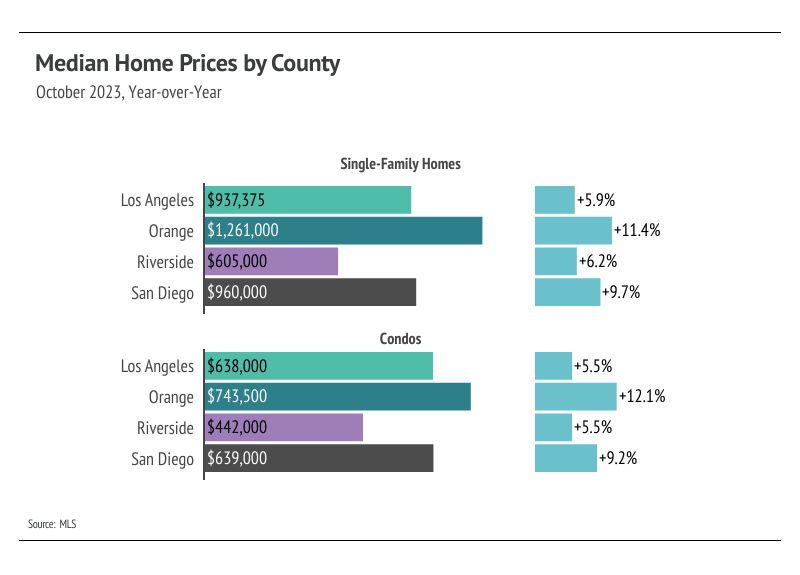

Orange County single-family home prices reached a new record last month. The continued trend of the low number of new listings is creating price support in the fourth quarter.

With mortgage rates hovering near a 23-year highs, buyers are being more selective, choosing the most desirable homes with the best features and upgrades that won’t require additional funds to update. Homebuyers are often using every dollar they have for their down payment, and don’t have additional cash after closing escrow to improve the home they purchase.

Inventory continues 14-month downward trend

Single-family home and condo inventory have trended lower over the past 14 months, which is not the seasonal norm. On December 1, there were 18 active homes available for sale in Cypress. This is 53% less than the 30 year average for this time of year. Cypress is on track for around 275 closed sales for homes and condos in 2003, down 48% from the 30 year average.

Typically, inventory levels peak in August and decline through January. However, in 2023, new listings have been so few, inventory remained fairly flat and even declined in the first half of the year.

As demand softens in the fourth quarter, buyers remaining in the market to purchase a home are gaining slightly more negotiating power and paying less than asking price on average. The average seller received 99% of asking price in July. By November, the average seller received 95%. Inventory will remain historically low through December, and likely remain at similar levels through the first quarter of 2024, which should help create price support.

A number of Orange County homeowners are considering selling in 2024 to take advantage of the current housing market that is still favoring sellers. Many are moving to other states, or more affordable areas in California where the equity in their current home allows them to purchase their new home in cash – or reduce their mortgage loan balance significantly. Orange County homeowner’s available equity in their home is averaging $600,000 – which often is enough to purchase their new home for cash in many other states. Many of our clients are moving to Texas, Arizona, Nevada, and Idaho. Others are choosing the areas in the Southeast including Tennessee, North Carolina, and Florida. Their California home equity is going far for them in these areas. We also have clients choosing Riverside County including Temecula and the Palm Desert area.

By the way; if you are considering a home purchase, we work with a lender that currently has access to a 30 year loan fixed at 6.375% for the first 7 years. We anticipate mortgage rates are likely to drop again in the next few years, and this is a desirable loan program for a home purchase today. Feel free to call, and I am happy to share more information why we love this loan program.

And if you are considering taking advantage of the current home price peak in 2024, definitely give us a call. We can share the latest information to help you make the best decisions for your next move.

And Now Receive Even More Profit when selling with our “Free Loan” to update your home!

We will Front the Cost to Prepare Your Home to Receive the Highest Price

This includes, Staging, Repairs, and Cosmetic Improvements

No Hidden Loan Fees – No Interest Charged – Ever

How does it work?

Quick: Our free loan is designed for speed. Work can begin now – and your home will sell fast.

Affordable: Eliminates costs and stress. No credit report * No loan application to fill out * No loan fees * No appraisal fee * No interest * No kidding!!

Intelligent: We help you determine the best updates and repairs that will bring you the most profit.

Easy: We are personally involved throughout the process, helping organize the work, and providing the best advice – start to finish.

We currently have buyers looking to purchase a Cypress area home from $800,000 to $1.8 million.

Call Cary direct at 800-944-2441 or email: Cary@Cary4Homes.com. We can review your best options to insure you receive the most profit when selling.

The call – just like our free loan – costs you nothing. And of course our conversations are always confidential. Let’s talk soon.

Cary Hairabedian & Valerie Cruz

Remax College Park Realty

Direct: 800-944-2441

Email: Cary@Cary4Homes.com

Website: www.Cary4Homes.com

Cary’s DRE: #00876519

Valerie’s DRE #01726223

Experience you can trust:

Real Estate licensed in California since 1984

Over $28 Million in home sales in 2022

Over $750 Million in career real estate sales

#13 of 6,100 Remax agents in California 2019

#42 of 62,000 Remax agents Nationwide in 2019

#99 of 130,000 Remax agents in the World in 2019

Cary’s Awards

Remax College Park Realty’s #1 agent: 1998, 1999, 2002, 2003, 2010, 2012, 2013, 2016, 2018, and 2019

20 time Remax International Platinum and Chairman’s award recipient

Copyright © 2020, All rights reserved.