Low rates could carry the housing market after coronavirus

In Fannie Mae’s most recent Housing Forecast, the mortgage giant has some pretty bold predictions about the future of mortgage rates.

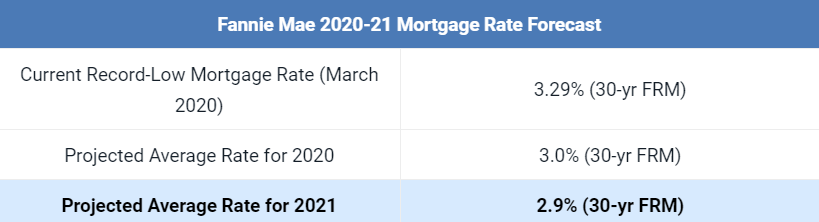

It says the average interest rate for 2020 will drop to 3% — before falling down to 2.9% in 2021.

That would mean an entire year of new record low rates for U.S. homeowners.And if the average does hit 2.9% next year, many homeowners with strong credit could see rates in the mid- or even low-2’s.

The good news is: Those who aren’t able to lock a mortgage rate in the COVID-19 economy might still have a chance at crazy-low rates well into next year.

This would make buying or refinancing possible for many who can’t afford it right now.

Verify your new mortgage rate (Apr 24th, 2020)

Fannie Mae forecasts mortgage rates in the 2’s

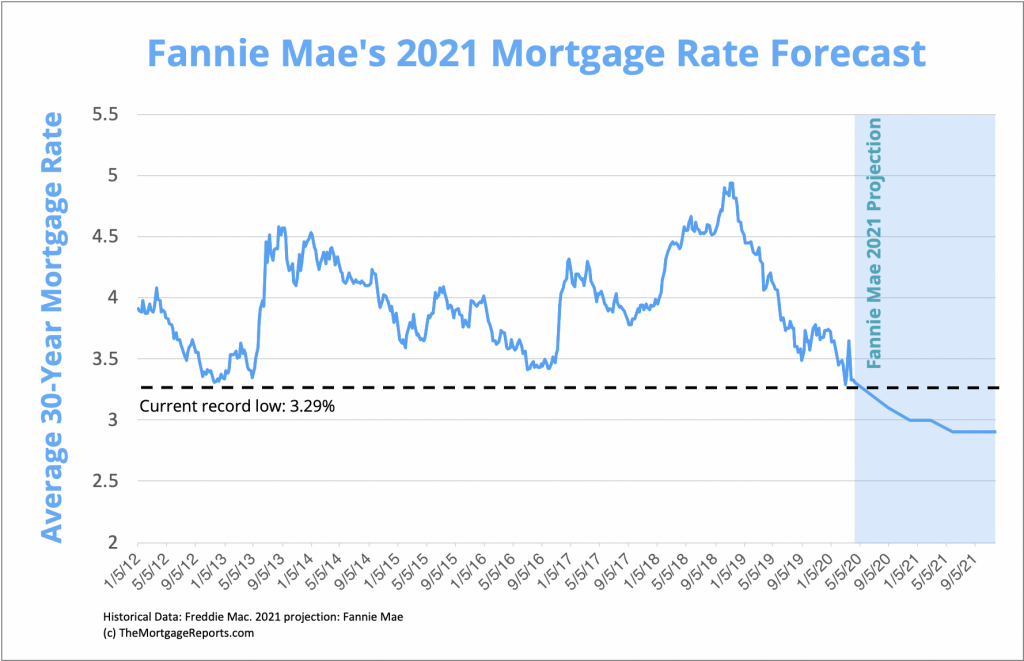

If Fannie Mae’s mortgage rate forecast comes true, we could see mortgage rates well below the record average for a year and a half.

Prior to this year, the lowest average mortgage rate was 3.31% in 2012, as recorded byFreddie Mac.

Enter March 2020. A new record low was set as rates dipped to just 3.29% amid coronavirus fears.

And now Fannie Mae says rates could be even lower throughout 2021 — predicting an astonishing 2.9% average for the year.

To put things in perspective, the average 30-year fixed rate in 2019 was just shy of 4%.

With a full year of record-low mortgage rates, many homeowners would be able to refinance, reducing their monthly payments and overall loan interest.

And prospective home buyers might be able to afford a house sooner than they thought — or buy a more expensive home than they’d be able to afford if rates were higher.

Fannie Mae remains optimistic about the housing market

Due to the coronavirus pandemic, we’ve seen mostly ominous signs when it comes to the U.S. housing market.

Demand has started to take a beating, and housing supply could be taking a big hit on account of a sharp decline in housing starts.

Add to the mix a massive jump in unemployment, and the possibility of another housing crash has analysts fearing for the worst.

Yet Fannie Mae’s predictions remain stubbornly optimistic.

Despite the economic impact of COVID-19, Fannie Mae predicts U.S. home prices will continue growing this year and next year.

What the rate forecast means for home buyers

As one of the world’s largest mortgage agencies, Fannie Mae is known for having less-than-aggressive economists offering conservative predictions.

Yet Fannie Mae not only predicts big things for home prices through 2020, but also even lower mortgage rates through 2021.

Suffice it to say, homebuyers should take heed.

Why? For one, your purchasing power could go up – way up.

What the rate forecast means for refinancing homeowners

The forecast for continued low rates is great news for those negatively impacted by today’s tightened underwriting standards.

The forecast for continued low rates is great news for those negatively impacted by today’s tightened underwriting standards.

If you haven’t been able to qualify due to lower credit scores, being self-employed, or other challenges making it difficult to qualify for traditional financing, the forecast for continued low rates means you haven’t missed out.

There are also plenty of good reasons to pursue a refinance now, if it makes financial sense for you.

- There’s no way to guarantee what’s ahead for mortgage rates. History shows that financial experts often get it wrong

- Rates are extremely volatile. In March, they hit the low 3’s but lenders raised rates by 1-1.5% in a matter of days

- Using an average rate of 3.3% (close to today’s rates), it’s estimated that approximately 50% of all homeowners could lower their rate by 0.5% with a refinance

- If rates drop to 3%, that estimate could jump from 50% to 70%. This could mean more homeowners flocking to refinance

- Increased refinance volume could once again impact refinance volume and lender capacity constraints. These constraints are likely to influence whether or not mortgage rates can even get to sub-3 levels

In short, rate forecasts look good. But a prediction is far from a guarantee.